Dear Sir,

Hope all is well with you and yours.

I would like to share with you some details on NewSpace Capital and “family-and-friends” pre-close round I would like to discuss with you.

NewSpace Capital is a leading space-focused Private Equity firm. We invest in growth stage deep-tech companies that deliver solutions to identified challenges and serve fast-growing markets. As the space sector reaches new heights, we focus on the technologies that enable it and applications that make it useful to the customers on Earth. Download a brief presentation. |

|

|

|

THE DISRUPTION OF ALL DISRUPTIONS |

|

|

|

|

Why Space? |

|

Space has become an integral part of our everyday life and is now a critical factor in the growth of the global economy. The orbits around our planet provide essential satellite infrastructure for our communication, networking, imaging, weather monitoring and navigation, – space holds the keys to further digital transformation. Read more |

|

|

|

|

THE GROWTH STAGE INVESTMENTS IN SPACE |

|

|

|

|

Down-to-Earth

Investments in Space |

|

|

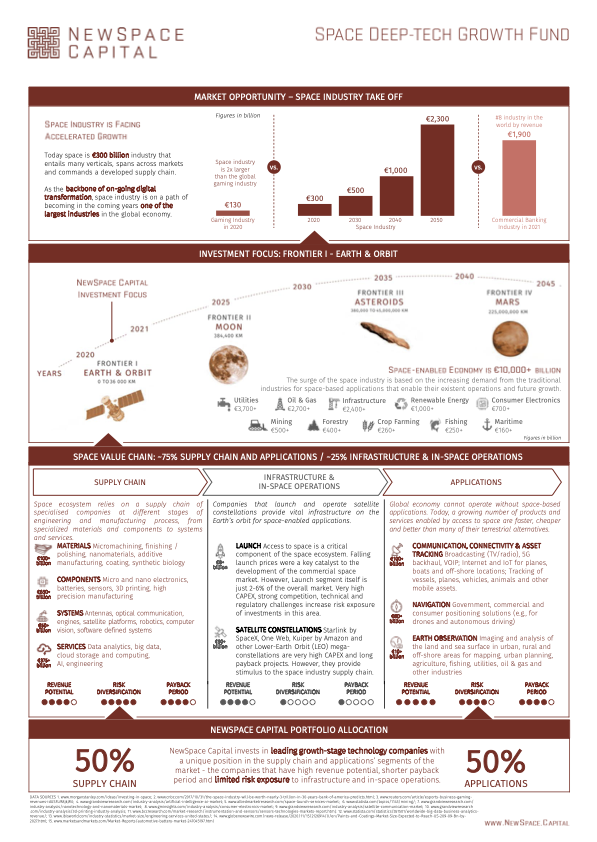

- Space is a €300+ billion industry (this is twice bigger than the global video gaming industry) and it is experiencing unprecedented growth. Both, JPMorgan and Goldman Sachs, estimate the space industry to become a €2 trillion industry by mid-century, i.e. one of the largest industries globally. In February of this year Morgan Stanley in its Space Economy report called space a “disruption of all disruptions” and “an industry on the verge of takeoff”;

- Rapid development of the space industry is demonstrated by over €10 billon of IPOs in the last three months and the launch of the first space-focused ETF (by ARK Invest);

- The industry attracted over €140 billion in investment over the last decade, but 75% of this was allocated to the US (less than 40% of the market) and to the launch segment (just 6% of the market). Majority of this investment was allocated to early stage companies;

- NewSpace Capital focuses on growth-stage companies leading in fast growing, but underinvested and undervalued segments of the market - supply chain and applications. Therefore, NewSpace Capital sidesteps technical and market risk, and accelerates payback by investing in companies with diversified commercial revenue base;

- Our first investment - €18,8 million in Finnish company ICEYE - has just announced a ten-fold (10x) yearly increase in its bookings. This demonstrates the pace of development in the space market and validity of our strategy.

|

|

|

|

GATEWAY TO THE SPACE MARKET |

|

|

|

|

Team of professionals |

|

Our team benefits from 150+ years of industry investment, commercial and technical experience across the global value chain. This experience and network gives us access to unique deals in undervalued market segments.

The 60-year-old space industry has been transformed in the last decade by improved access to space, emergence of satellite platforms for Lower Earth Orbit, miniaturization of electronics, changing regulatory environment and growing demand for commercial and consumer applications. The global space industry now spans across multiple markets on Earth and beyond, becoming a key positive element in the technological and economic transformation of our society. |

|

|

|

|

|

|

|

What We Invest In |

The first close of the fund (€100-150 million) is scheduled for the end of the year. Existent investors include the Luxembourg government (SNCI) and Mubadala. In the meanwhile, we have regulatory and LP approval to perform pre-close investment in a number of opportunities. The benefits for the pre-close investors include: |

- Pari passu participation in the ICEYE deal on the last round valuation (12 months-old enterprise value);

- No formation expenses;

- Minimum ticket of €500K (top up without ticket limits in the following rounds);

- Equalization interest at First Close.

|

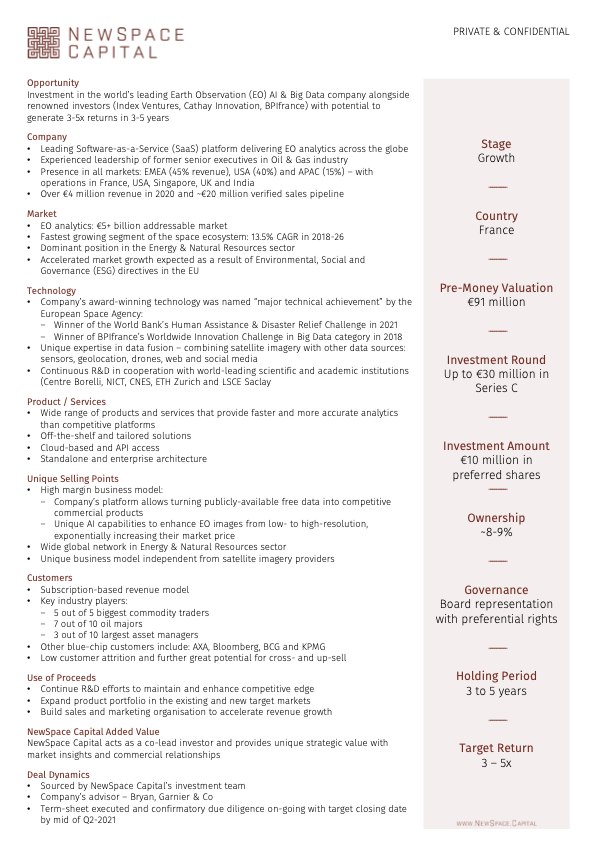

Some of these investment opportunities are described below along with two examples of existing deals. |

|

|

|

|

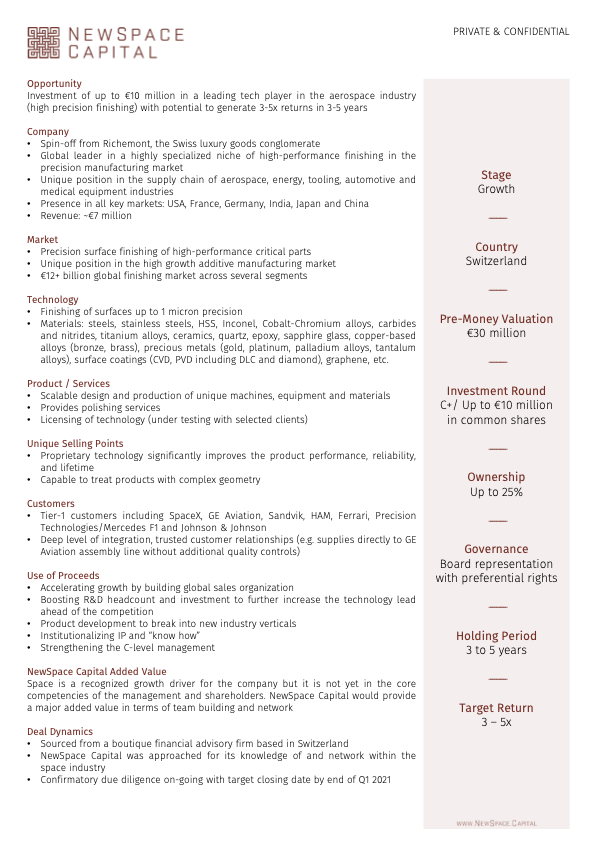

Please click on image to enlarge |

|

|

|

|

|

|

|

|

At the time of the Space Rush, we invest in “picks & shovels” – the supply chain and downstream segments of the market. We lower risk by investing in leading companies with existent revenues and unique market position, and supporting management teams that demonstrate vision, clear strategies and track record of focused execution. Read more |

|

|

The following are few articles on the market that will help you better understand the market scale and the general trend in the space investment field. |

|

|

|

|

|

|

I would be happy to share more details with you as a next step. Looking forward to discussing the above in more detail. Hope we can talk soon. |

|

|

|

Dr. Slava G. Turyshev

Industry Advisory Board Member |

|

|